November 5th marked an extremely important fork in the road day for crypto people globally. For those of you without context here, the SEC has failed to provide any clear guidance to crypto companies to be compliant, then turns around and sues them for not being compliant. This lack of regulatory uncertainty has led to the stifling of a lot of crypto innovation and created unnecessary barriers for the industry — all while letting actual scams and ponzis run rife.

When Trump launched his own NFT collection in 2022, we knew things were going to be a little different with how he viewed crypto. However, the biggest pivot was July 27th 2024 at the Bitcoin conference in Nashville, where he announced he’d fire Gensler and create the Strategic Bitcoin Reserve for the US. Given no democratic candidate had spoken so openly about how they’d help or advance crypto, this really changed the dynamics of how $100m+ of crypto PAC money would be allocated. There was still skepticism, rightfully so, about how much of this was to pander to the crypto crowd versus actually following through.

Fast forward to a version of the world where Trump is president and the Republicans control the House and Senate (the two major divisions of government that are required for legislation to pass), we live in a new world. It’s still hard to understand all the implications of what this means but I thought I’d write this article to break it down and explain how I believe the market structure will change as a result.

The first win was technically earlier this year when the Bitcoin and Ethereum ETFs went live. Outside of our bags pumping, it meant that it is very hard to make Bitcoin or Ethereum “illegal”. Doing so would cause any regulated US institution to lose money on their holdings. In order to do it, a politician would have to push it through and most likely work against the interests of the hand that feeds them directly. IBIT currently owns ~$40b worth of Bitcoin. To mark that to 0 causes way too much pain for any politician to pull off without losing the support of their donors.

Still, things around how exchanges should be treated, stablecoins are viewed and what makes a token a security — were not clear. What we do know is that the person in charge for authorising the SEC to act, Gensler, will be gone and replaced with a much more pro-crypto candidate. Outside of things that are outright scams, the bar for what is legally risky is far lower. Two weeks in and we’re already seeing exchanges list pretty much anything they want, including retarded memecoins (which I buy and hold lmao).

It speaks to a larger point around deregulation around Trump’s style of presidency. While it will be fantastic for innovation, it also means that ethically questionable practices will also increase. Can’t have the good without the bad. Self-regulation is the only hope this industry has and so far there has been very little of it.

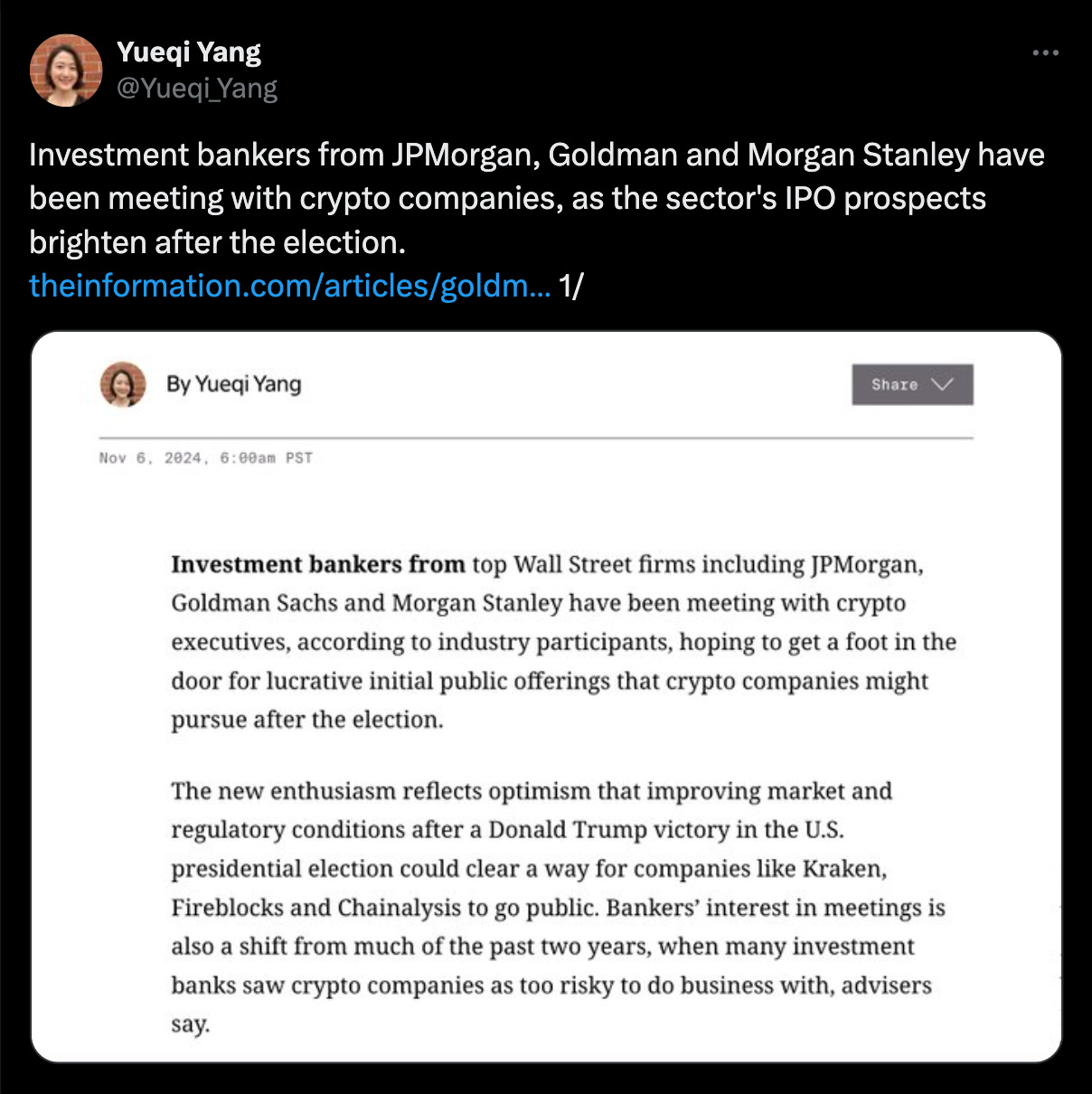

A second order effect or regulatory certainty means that the pathway for crypto IPOs increases massively as well. If companies know that before going public they don’t have to fight the SEC, the pipeline of crypto IPOs becomes massively more viable. As a result, private deals won’t just be priced on whether a token has to happen or not, but rather a pathway for how it might one day get listed on the NASDAQ. As a by-product, the more healthy publicly listed companies there are, the larger the market for M&A activity to take place — something that has been historically sparse. I think the larger point here is that the market becomes more efficient and the pathways to deploy capital become more well-trodden with less immaturity. If private markets were frothy in the last cycle, expect them to be even more frothier this cycle.

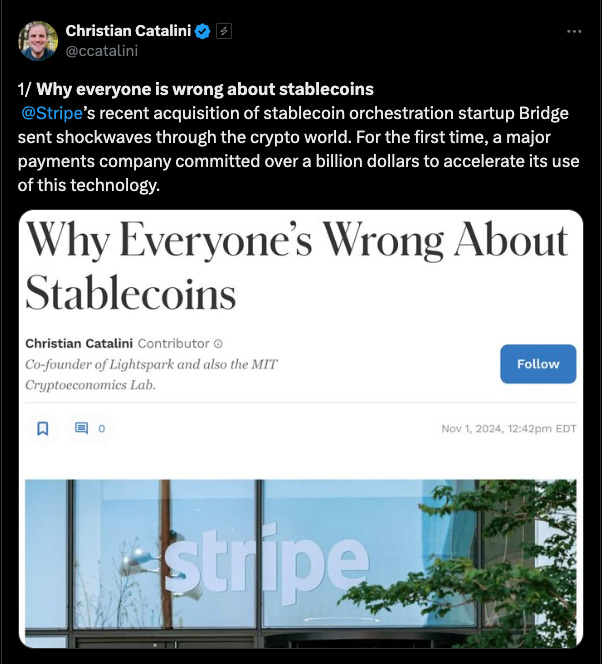

The third order effect of clearer crypto private financing markets is also increased appetite for riskier ideas that require more “reliance” on the real world. A key vertical I see here is payments. Previously they were very challenging given the numerous banking and KYC/AML hoops that companies had to go through,6* however those walls are going to be torn down. In addition, with increased funding, investors are going to be happy to fund more experiments. Given Stripe recently acquired Bridge for $1b the relative valuation plays and market for other acquirers for a crypto payments arm just expanded:

Crypto is typically cool when prices go up and everyone is getting rich. However, when prices go down the industry is viewed as a place where only scammers work. There’s never really been any large figures in government administrations that have stood behind crypto and helped rally the perception of it. This matters because many normies follow what those around them say about the world. Whether you like him or not, Elon and Trump are massively populist figures that have enormous amounts of social, political and actual capital behind them. Whatever they say is “cool”, will quite quickly permeate through at least half of society.

You already see it with the “Department of Government Efficiency” aka DOGE that everyone will now repeat non-stop for the next year. Given how strongly people feel about government waste and inefficiency, it’s kind of crazy that you can buy a meme coin called DOGE that expresses that view and allows you to make money to earlier you buy into it as well. I wouldn’t be surprised if there were more meme coins around various branches of the government as well that crop up. Pnut is already a fascinating one: the euthanised squirrel authorised by the democrats now lives to be a multi-billion dollar market cap token is absolutely nuts.

At the same time, if last cycle we saw B-list celebrities pumping weird NFTs and their own personal coins — I don’t think we’re too far from major A-list celebrities following in this upcoming cycle. Given the intersection between entertainment and crypto will expand massively, expect to see more crypto culture get exported to adjacent industries over the next few years.

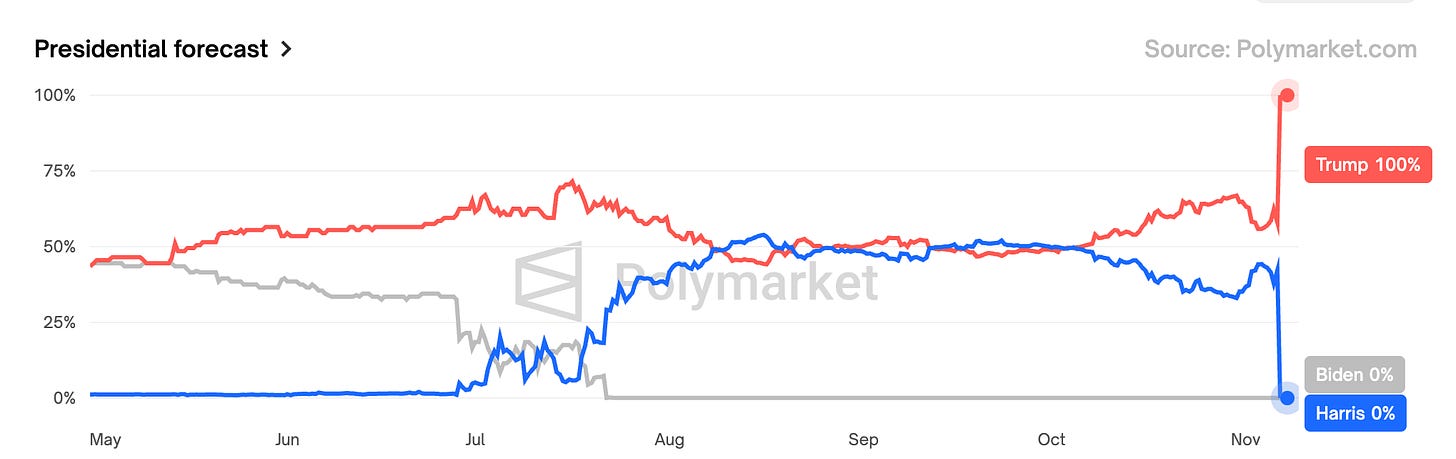

One massive factor in perception for this cycle has been Polymarket. Where polls and the media were biased and painted an inaccurate view of the elections, Polymarket doesn’t give a fuck and tells you what it is, exactly how it is, in real time. While many called “manipulation”, we learned once again the the wisdom of the free markets is very rarely wrong. Congratulations to the French whale for making the killing of a life-time. As many people are now very comfortable with crypto based prediction markets, expect to see more prediction market apps with many more markets come online!

Many other sites eventually converged to the same odds as Polymarket, but with far less liquidity and speed. I think one thing I want to understand is at what point do we deem markets to be “big enough” to be accurate information sources. Being able to tap into the collective wisdom of the crowd is still under appreciated in my view but will be more so moving forward. I already use Polymarket to get a gauge of what interest rates at the next FOMC meeting will be looking like given there’s markets for it.

Trump’s main policy revolves around increasing tariffs, decreasing taxes and bringing manufacturing back to the US. It’s hard to say if it’ll work or not given the gamble is that the increased costs for consumers will be offset with a higher post-tax income. Regardless, these policies will be largely inflationary and most likely increase the money supply in some way shape or form. The bond market has largely priced in the fact that a Trump presidency will lead to higher rates — evident through the 10Y rate spiking and not moving down despite the Federal Funds rate being reduced.

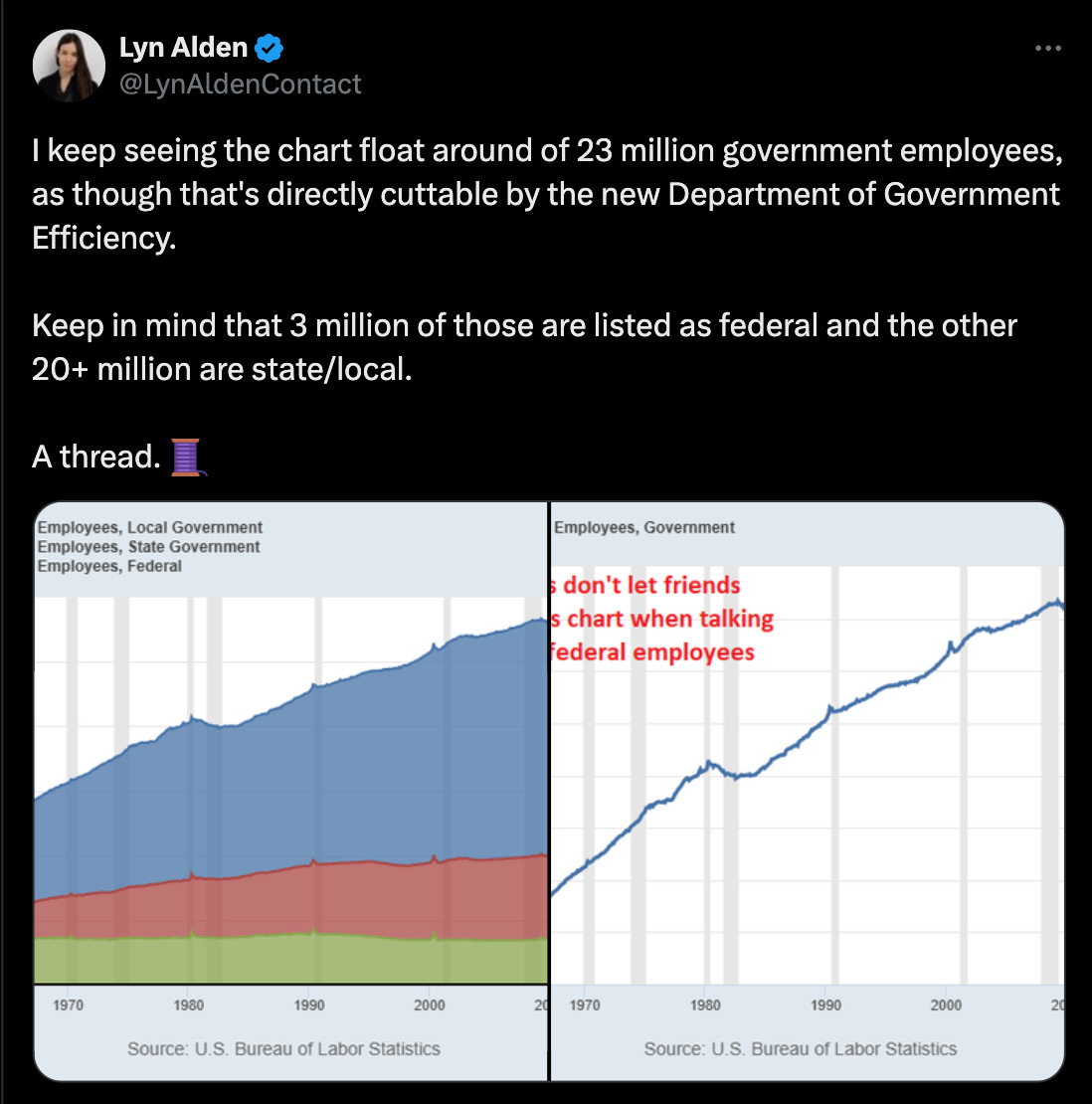

Many would counter my point that the DOGE will be able to offset these costs by cutting down government size. I don’t think this is accurate and potentially misleading. Here’s a thread by Lyn Alden who breaks this dynamic down very well:

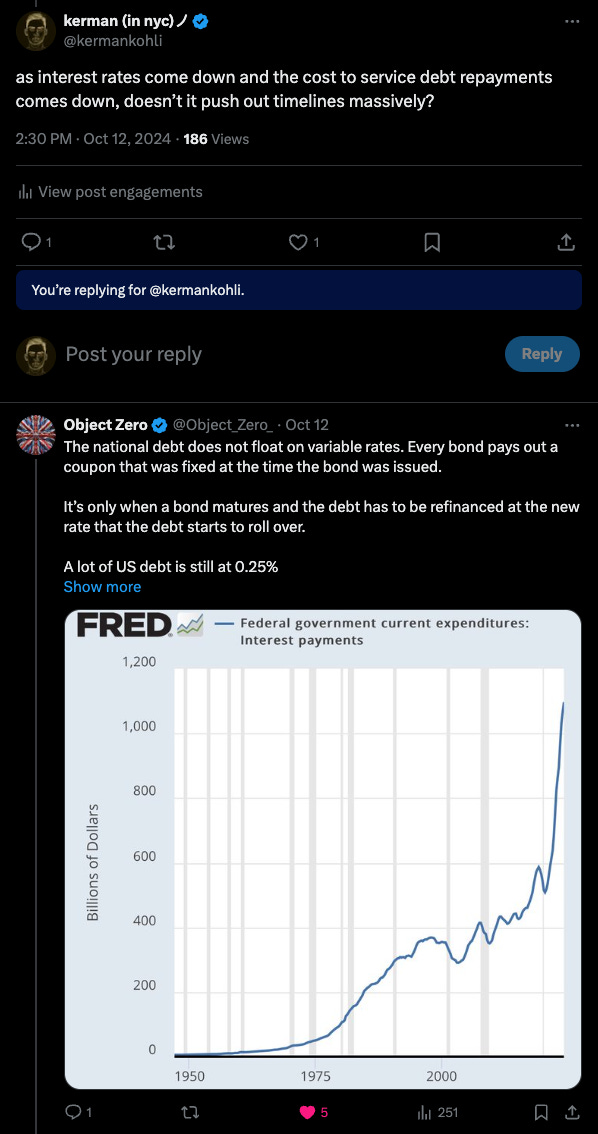

The main culprit of why the US dollar is going to get cooked is described succinctly in this thread below. TLDR: Majority of the debt is rolling from a 0.25% interest rate to 4.75%.

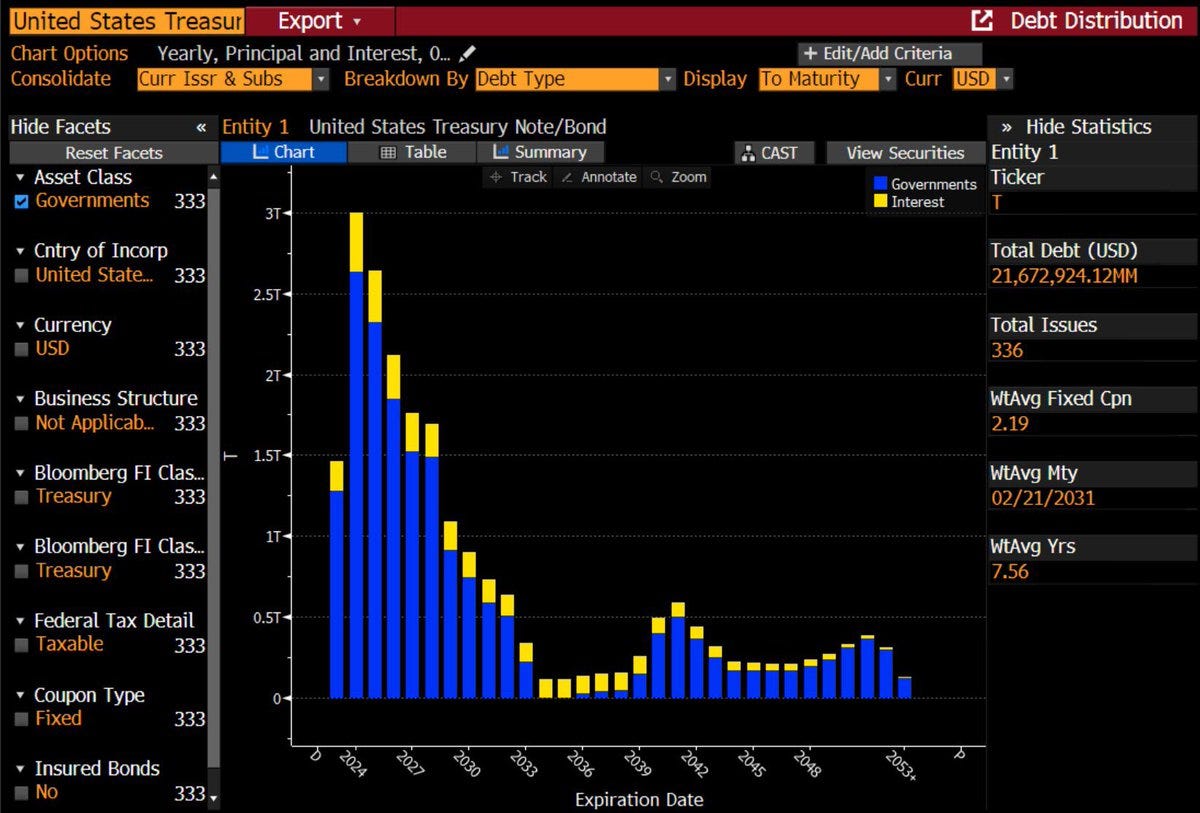

Majority of the 4.75% issued debt will roll-over in 2033 as evident through the chart below. While the cost might be lower with the federal funds rate being reduced, if the bond market is demanding higher yields to be compensated for the inflationary environment that will be persistent, the cost of financing moving forward will be just as expensive for the government. If there’s one thing I’d recommend to everyone here it’d be understanding what the bond market is saying about the state of the world.

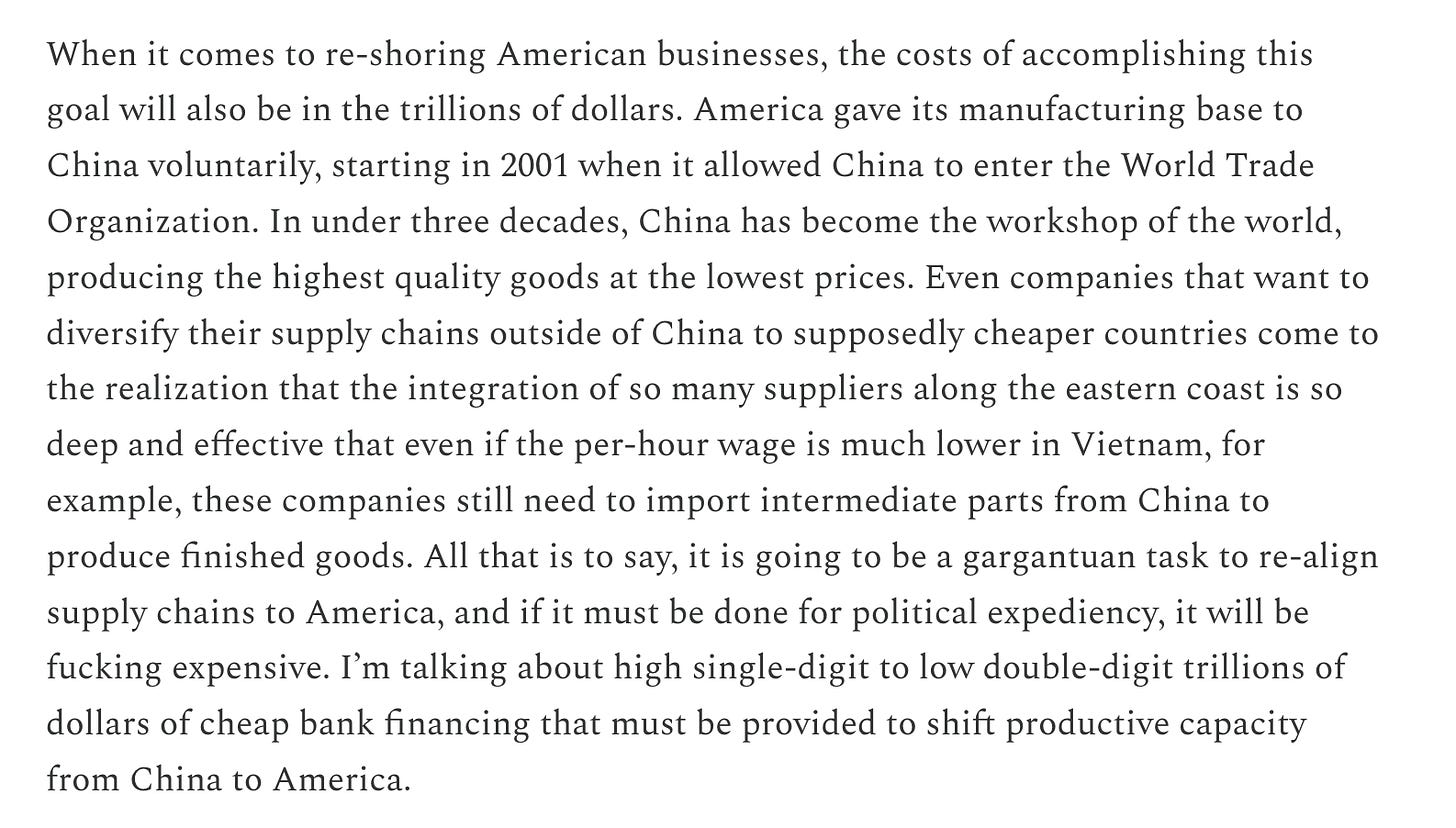

If you thought that was the only cost that you need to look out for, the other part here is that the cost of bringing back manufacturing to the US will likely be in the trillions of dollars. The entire first world for the past 20 years has off loaded manufacturing to China and now bringing back that capability nationally is going to cost — a lot. You should read Arthur Hayes’ new article here to get a full understanding of this plays out

As Lyn Alden says “nothing stops this train”. Money will be printed, and alongside it valhalla-like green candles for gold and Bitcoin.

Now that the flood gates for crypto have truly opened, we have a new dimension of demand that was there but is now accelerated: competitive demand between companies and nation-states. Lets start with companies because we can already see this live.

Michael Saylor will probably be one of the richest people alive given how much Bitcoin Microstrategy owns. He has unlocked one of the greatest money glitches: issue low yielding corporate bonds with no recall terms and use it to buy more Bitcoin — on repeat. What’s interesting though is that if once upon a time you looked like a fool for having Bitcoin on your balance sheet, in the future you will be a fool for not holding any.

Tesla currently holds $1b+ in Bitcoin as well. Expect this trend to accelerate faster as money continues to lose value due to the excessive printing of it. Bitcoin is a levered version of gold. The other dimension of competition is sovereign nation states holding Bitcoin in their reserves and outcompeting each other. If the US is talking about a strategic Bitcoin reserve, Bhutan is already on it:

The amount of buy pressure as all these corporations and countries buying Bitcoin as a hedge against their own incompetence will be a sight to behold. You really can’t be bullish enough.

In case you didn’t read my last article on the USDJPY, we’re also starting to see it melt-up and when this bomb drops we’re going to see the worthlessness of government currencies become very apparent.

While there are many more aspects I could talk about about the Trump Trade, these are some of the key variables that I think everyone should be watching out for. History had a huge fork in the road and the next few months it will slowly become more clear to everyone just how much of a course change happened with Trump coming into power with a full Republican sweep. If there’s anything in this article you feel like went over your head or you’d like me to go deeper on let me know and I’m happy to expand!

Happy bull market everyone, may your coins rip as hard as the most 80-IQ microcap memecoins coins that exist out there!