Nvidia‘s (NASDAQ: NVDA) stock has been a huge winner each of the past two years. After surging over 238% in 2023, the stock has soared approximately 164% this year, as of this writing. Those are two huge back-to-back year gains that have propelled the company to become one of the largest in the world.

The question is, can the stock hit the market with a three-peat of outsized gains in 2025? Interestingly, the stock has been able to generate returns of 30% or more for three straight years on four previous occasions and returns of 50% or greater for three straight years twice. It has never had four years in a row of 30% or more returns, but it did have one stretch where its stock rose by 25% or more for five straight years from 2013 to 2017.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Let’s look at why I think Nvidia can turn in another year of strong performance in 2025.

Insane demand for AI chips

Any investment in Nvidia centers around spending on artificial intelligence (AI) infrastructure. The graphics processing units (GPUs) that it designs have become the backbone of the AI infrastructure buildout, as GPUs can perform many calculations at the same time, making them ideal for use in training large language models (LLMs) and running AI inference.

Meanwhile, as AI models become more sophisticated, they need exponentially more computing power, and thus GPUs, to advance. For example, both Amazon‘s Llama 4 LLM and xAI’s Grok 3 model were trained on 10 times as many GPUs as their predecessors trained on.

Demand for GPUs is being driven by large hyperscale (companies with massive data centers) tech companies (such as Microsoft, Alphabet, Amazon, and Meta Platforms) as well as well-funded AI start-ups like OpenAI and Elon-Musk backed xAI. Currently, these companies are all racing to create the best and most powerful AI models, leading to what Nvidia has called “insane” demand for its newest-generation Blackwell GPUs.

However, growth is not expected to stop, with Nvidia’s largest customers, by and large, indicating that they plan to spend more on building out data centers to help power their AI ambitions. Nvidia customers such as Meta Platforms and Alphabet have said the biggest risk with AI infrastructure is underinvesting, as they look to capitalize on what they see as a generational opportunity. Oracle, meanwhile, has said it expects strong AI infrastructure growth to continue over the next five to 10 years.

Image source: Getty Images.

A wide moat

Nvidia isn’t the only company that makes GPUs, but it has been able to create a wide moat in large part due its CUDA software platform. GPUs were originally developed to speed up graphics rendering (hence the name) in applications like video games. However, as Nvidia looked to expand the use case for these chips, it created a free software program that allowed developers to program its chips for other tasks.

While it took time, this led to CUDA becoming the standard on which developers learned to program GPUs for various tasks, creating the wide moat it has today. Meanwhile, it was arguably the use of its GPUs in cryptocurrency mining that really helped set the groundwork for Nvidia’s current AI success today, as it demonstrated the power of its GPUs in high-performance computing.

Nvidia has not sat still following its initial CUDA development and in the years since it has built domain-specific microservices and libraries on top of Cuda, called CUDA X, to better optimize it for AI. Meanwhile, the company has also sped up its development cycle for its GPUs to once a year in order to remain at the forefront of GPU technology.

The company’s biggest challenge at the moment appears to be coming from custom AI chips, such as those Broadcom helps develop for customers. These are custom chips designed for very specific tasks, and thus they can be more efficient. However, it also takes time to design and manufacture custom chips, and like most custom things, they are more expensive. In a world racing for AI, Nvidia’s chips are more accessible and cheaper and have an array of AI-specific microservices and libraries through CUDA X.

As such, while custom AI chips will likely continue to take some share, Nvidia still looks like it will remain the king of AI chips for the foreseeable future.

Inexpensive valuation

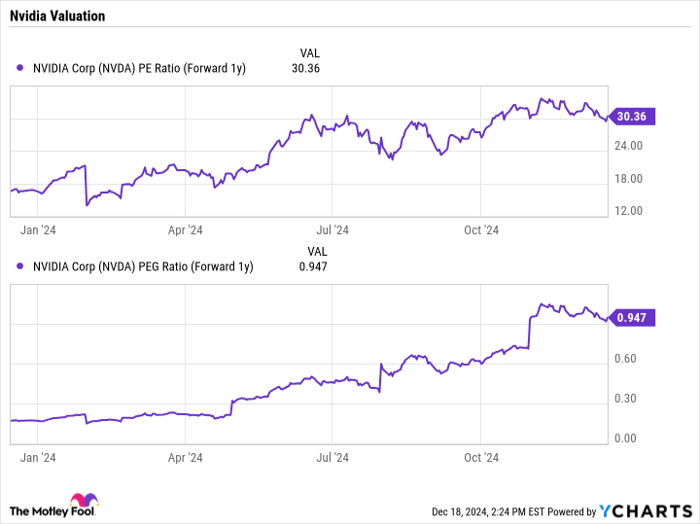

The final reason why I think Nvidia is poised for another year of outperformance in 2025 is its valuation. Despite its huge gains over the past two years, the stock only trades a forward price-to-earnings (P/E) ratio of about 30 based on 2025 analyst estimates, and a price/earnings-to-growth (PEG) ratio of approximately 0.95. A PEG ratio under 1 is typically viewed as undervalued, but growth stocks will often have PEG ratios well above 1.

Data by YCharts.

For a company that just saw its revenue grow by 94% year over year last quarter and which is projected to see 50% revenue growth in 2025, that’s an attractive valuation. With AI looking to be still in its early innings and the company having a wide moat, the stock looks like a buy heading into 2025.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $349,279!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,196!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $490,243!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.