As cryptocurrency has continued to grow in popularity, so too has the need for strong tools that can effectively track market data, monitor portfolios, and keep individuals abreast of trends. CoinMarketCap has been at the forefront of such platforms for quite some time, but users are starting to explore other options that provide more critical functionality pertaining to the tracking of DeFi and additional security measures.

In this blog, we’ll explore De.Fi as the ultimate CoinMarketCap alternative, explaining in detail why it stands out thanks to its advanced tools, real time market tracking, portfolio management, and user-oriented features. We will also look at how these unique offerings make De.Fi an excellent choice for users that demand an all-in-one solution.

What is CoinMarketCap?

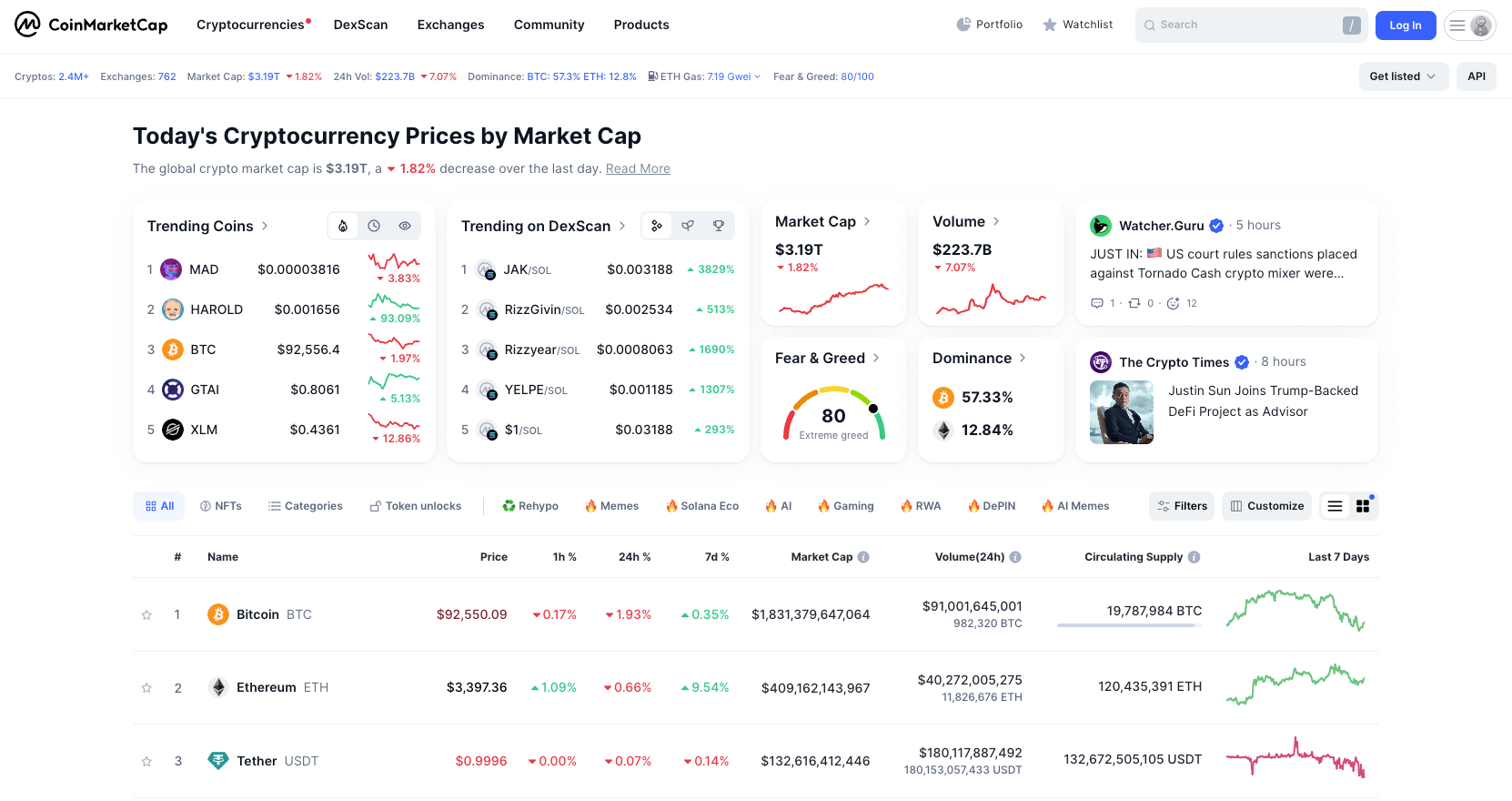

CoinMarketCap is among the leading websites for tracking cryptocurrency markets. It was created to track the prices of cryptocurrencies in real-time, along with their market capitalization, trading volume, and ranking. Founded in 2013, the site has become a valuable source for crypto enthusiasts and traders who seek to stay atop happenings in the world of cryptocurrency. It’s an aggregator of data from hundreds of exchanges into one easy-to-navigate platform; hence, it is a source for both amateur and pro traders.

Apart from tracking prices, CoinMarketCap offers a set of other tools that include portfolio trackers, watchlists, and cryptocurrency price comparisons. One is also able to observe historical data, charts, and information about several exchanges. While CoinMarketCap is very helpful for general market analysis, it still misses a few things that could be essential in an advanced user: better security, direct integration with DeFi services, and real-time auditing of smart contracts.

That is where De.Fi steps in. Because of this, users have been driven to find an alternative to CoinMarketCap, one that provides them with a broader range of features and services.

De.Fi: The Best CoinMarketCap Alternative

De.Fi has positioned itself as a top contender for users seeking a more comprehensive platform than CoinMarketCap. It offers a wealth of features that go beyond simple market data tracking, making it the best CoinMarketCap competitor for those interested in web3, crypto portfolio management, and DeFi security. Below, we’ll take a closer look at the key features that make De.Fi the best CoinMarketCap website alternative.

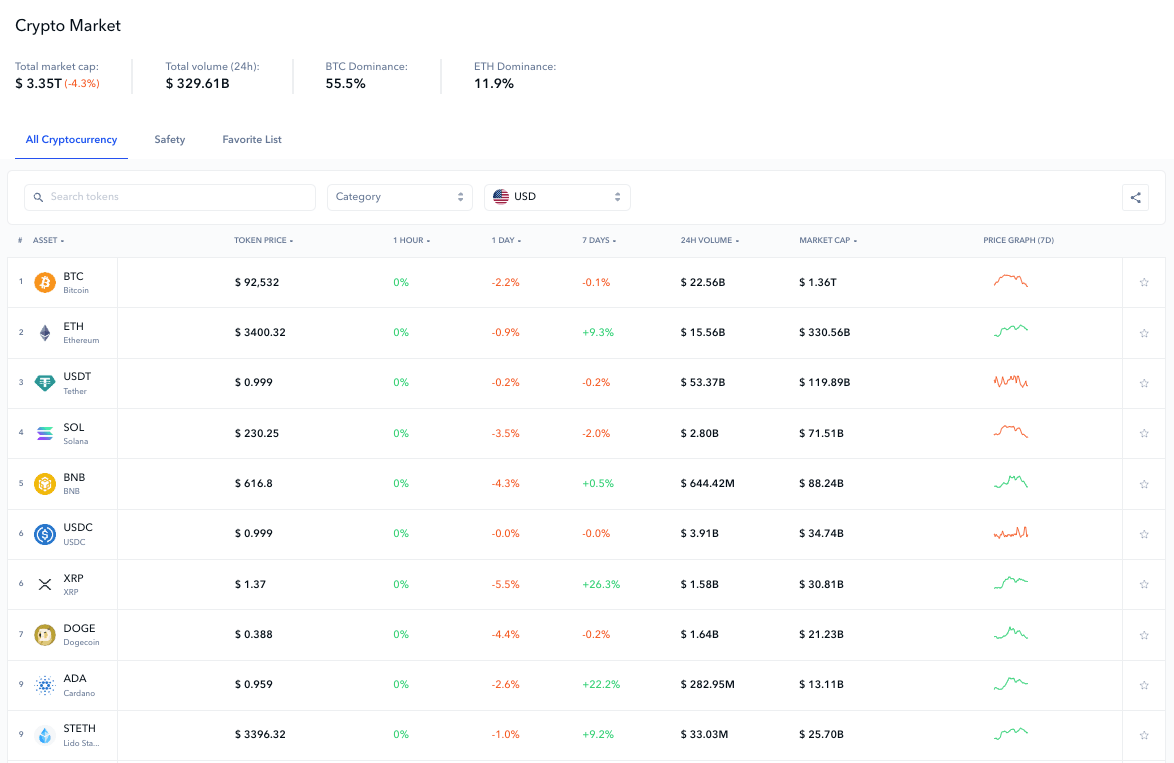

Crypto Market Overview

De.Fi’s Crypto Market Overview functions similarly to CoinMarketCap’s homepage, displaying a detailed snapshot of the cryptocurrency market. Users can view real-time data on token prices, trading volumes, and market capitalization. However, where De.Fi stands out is in its ability to combine this traditional market data with DeFi-specific metrics, such as staking options, liquidity levels, and security ratings.

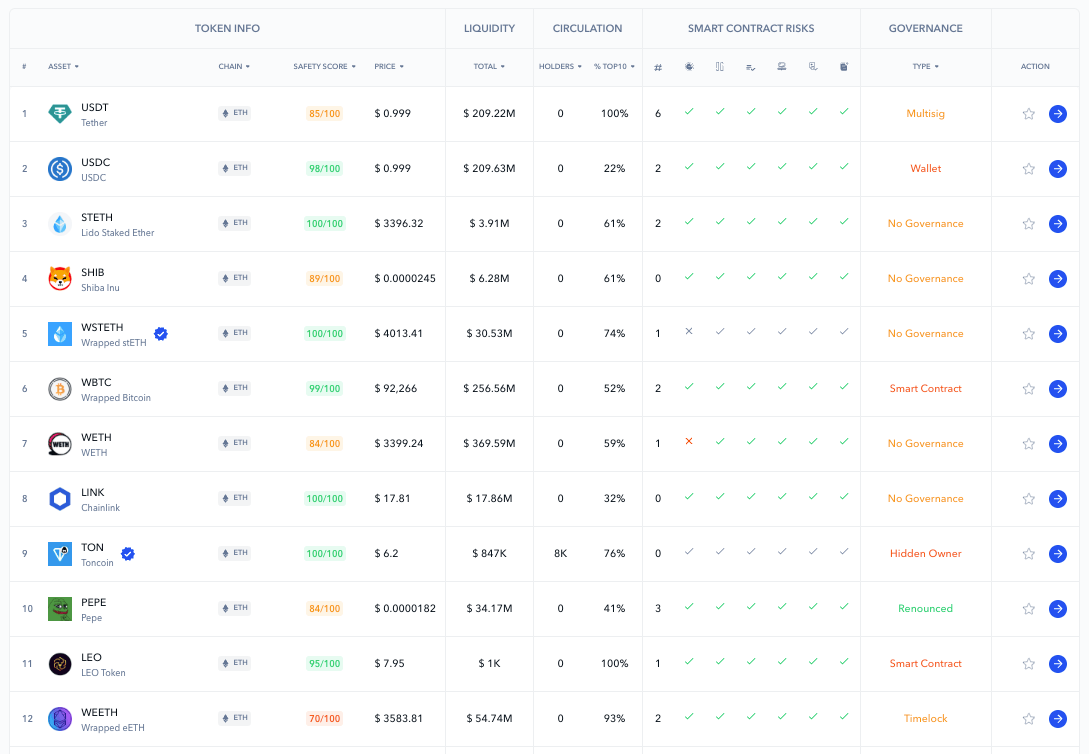

Market Security Overview

One of the most notable differences between De.Fi and CoinMarketCap is the emphasis on security. De.Fi’s Market Security Overview is a unique feature that provides a thorough assessment of how secure different tokens are. It includes data on contract audits, token liquidity, and governance, helping users evaluate the safety of their investments. While CoinMarketCap focuses heavily on market performance data, De.Fi ensures users are also informed about potential security risks, making it a more comprehensive CoinMarketCap DeFi tracker.

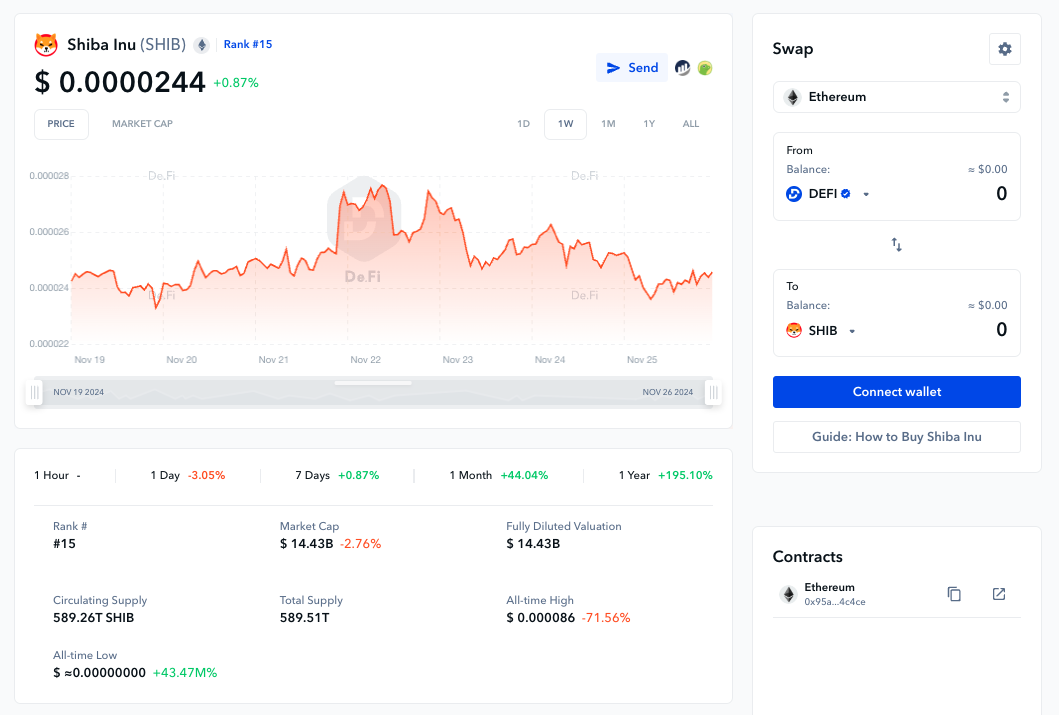

Token Pages

De.Fi’s token pages are another standout feature. These pages provide users with detailed information about each token, going beyond price data to include liquidity levels, staking options, and swap functionalities. For example, users can view how a token is performing across multiple DeFi protocols, access yield farming opportunities, or execute a swap directly from the token page.

CoinMarketCap’s token pages, while informative, do not offer the same level of integration or interactivity, making De.Fi a better alternative to CoinMarketCap for users looking to engage directly with DeFi.

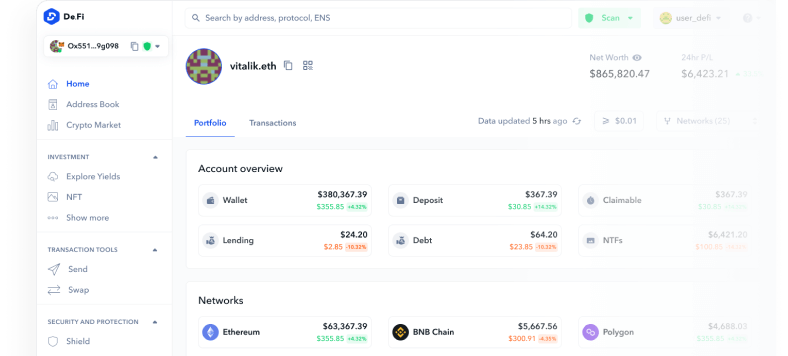

Comprehensive Portfolio Dashboard

De.Fi’s Portfolio Dashboard is designed to give users a complete overview of their DeFi assets. It consolidates all the user’s assets across multiple wallets and blockchains, showing real-time data on tokens, deposits, claimable rewards, and lending positions. This dashboard also includes a historical transaction view, making it easier for users to track their investment activities for tax purposes or performance reviews.

Compared to the CoinMarketCap portfolio tracker, De.Fi’s dashboard offers far more detailed insights, including the ability to view staking and yield opportunities directly from the portfolio interface. This is made possible by a seamless integration with the Explore Yields tool. Users can find new ways to put their assets to work without ever having to leave the dashboard. This level of functionality makes De.Fi the superior CoinMarketCap portfolio alternative for those seeking an all-in-one solution for managing and growing their DeFi investments.

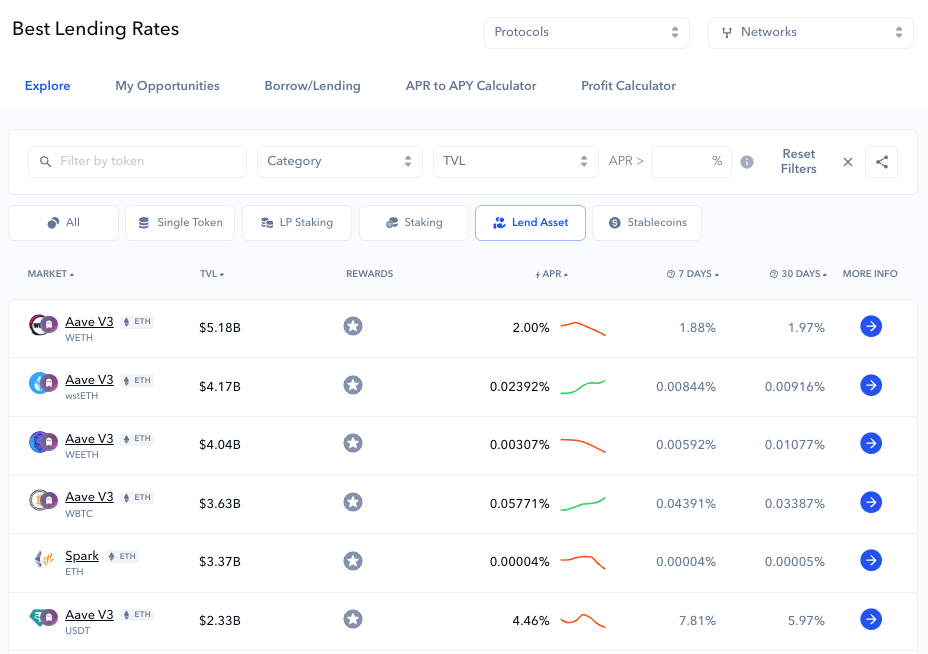

Explore Yields Tool

De.Fi’s Explore Yields tool is one of the platform’s flagship features. It allows users to explore yield farming and staking opportunities across multiple DeFi platforms, with data filtered by token, blockchain, asset type (such as stablecoins), and more. This feature is particularly valuable for users looking to optimize their returns, as it provides detailed analytics on yield opportunities, including historical data over 7-day and 30-day periods.

Lending rates via De.Fi Explore

By integrating the Explore Yields tool with the Portfolio Dashboard, De.Fi enables users to not only monitor their existing investments but also discover new ways to generate passive income. This makes it a more robust solution compared to the CoinMarketCap portfolio tracker, which does not offer direct access to yield farming or staking opportunities. For users who want a more hands-on approach to maximizing their crypto holdings, De.Fi is the ideal CoinMarketCap portfolio tracker vs De.Fi option.

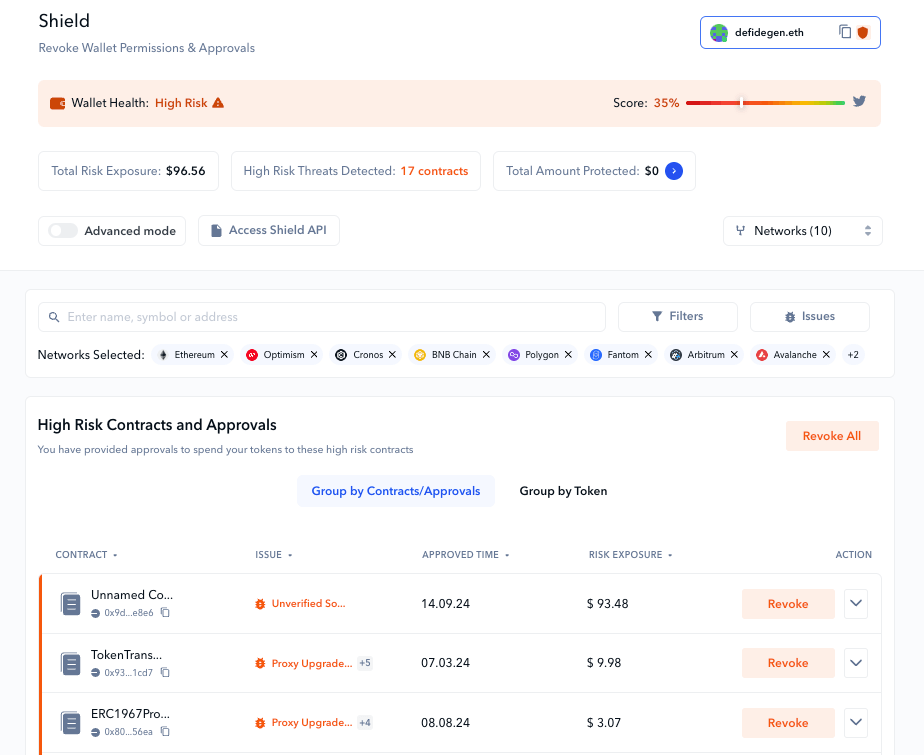

Antivirus Features (Scanner and Shield)

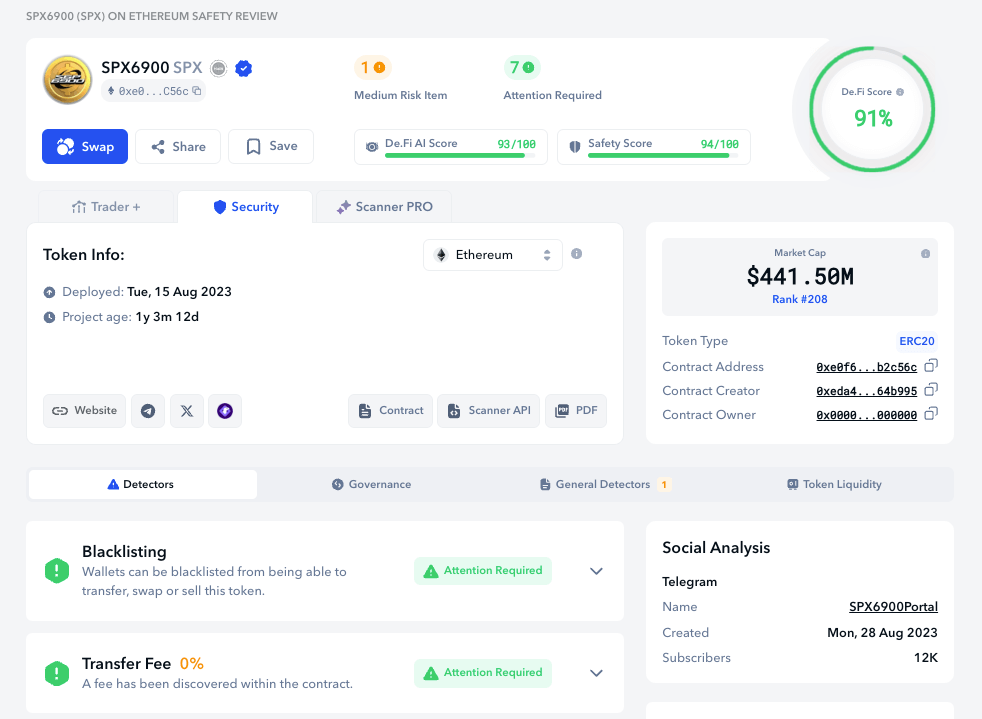

Security is a major concern in the DeFi space and De.Fi addresses this with its Web3 Antivirus Suite, which includes the De.Fi Scanner and De.Fi Shield. These tools allow users to audit smart contracts in real-time and manage token approvals, ensuring that they stay protected from malicious contracts or poorly designed protocols.

The De.Fi Scanner provides a comprehensive analysis of smart contracts, identifying potential risks such as liquidity issues, governance vulnerabilities, and dump risks.

Analysis of SPX6900 on Ethereum

Meanwhile, the De.Fi Shield helps users manage and revoke token permissions with a single click, preventing unauthorized access to their assets.

These advanced security features are not available on CoinMarketCap, making De.Fi the more secure CoinMarketCap competitor for users who prioritize safety in their crypto investments.

Educating Yourself With De.Fi

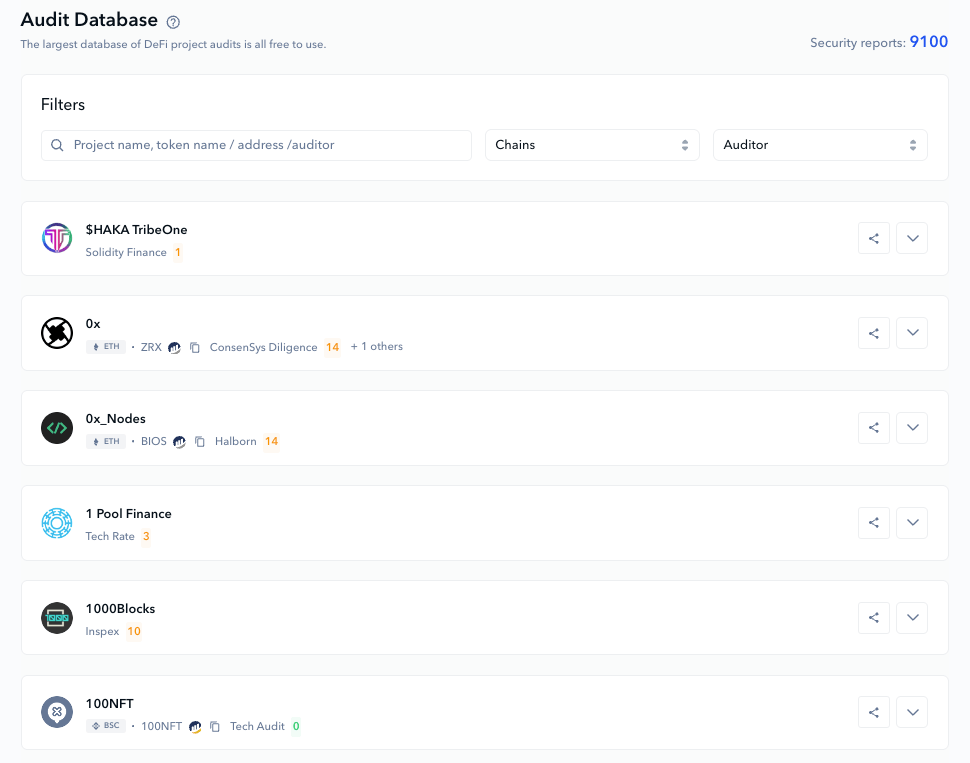

Alongside this powerful suite of tools, De.Fi places a strong emphasis on education in the DeFi space, recognizing that informed users are those best equipped to handle the more complex and even riskier aspects of decentralized finance. The most prominent proof of De.Fi’s commitment to education is Audit and REKT databases.

The Audit database is a public good that consists of deep analysis about DeFi protocols. It contains the collective knowledge of years of smart contract code audits, liquidity assessments, governance model reviews, and overall vulnerability assessments. This helps users understand the security and stability of various projects before committing their assets.

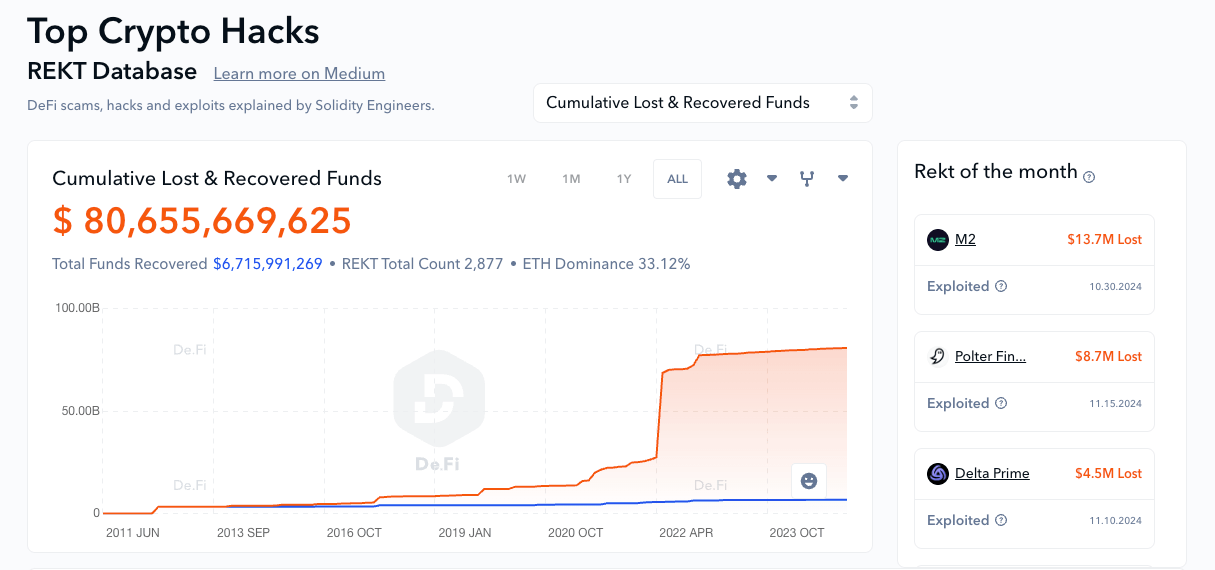

Meanwhile, the REKT database is a vast repository of historical hacks, scams, and exploits. This will allow for a proper mapping of potential pitfalls within the DeFi space. As such, an in-depth look can be made into the possible ways to avoid each pitfall. This extensive repository encompasses all aspects from rug pulls to protocol failures. New and seasoned investors alike have a lot to learn from these valuable insights.

Beyond the databases, De.Fi fosters a rather active user community through its education-oriented blog. From basic explanations of DeFi concepts, the wide-ranging blog topics encompass in-depth articles on the hottest narratives in space, among them yield farming, staking, and liquidity provision. These educational updates are quite frequent and oriented to keep users abreast of recent trends and developments in DeFi.

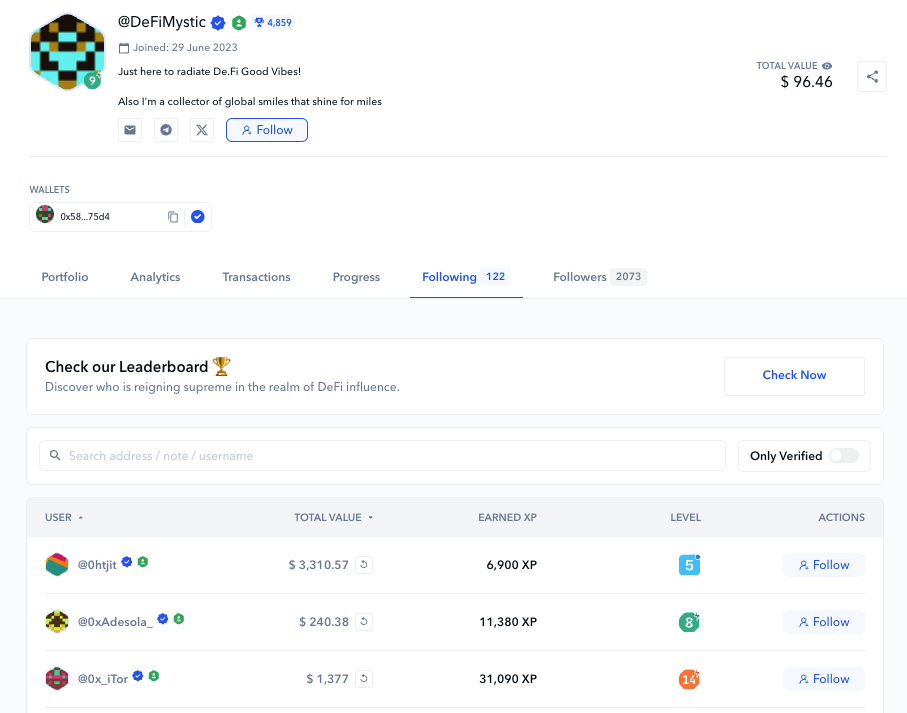

De.Fi also embeds SocialFi capabilities, enabling users to leverage the collective wisdom of the DeFi community in distilling useful insights or “alpha” from other active investors and enthusiasts. SocialFi – a combination of social media and decentralized finance – allows users to share experiences, yield strategies, security concerns, and other insights within the DeFi ecosystem.

Moreover, De.Fi is on platforms like X to ensure that its users get minute updates regarding project developments, security news, or market shifts. With this kind of continuity, De.Fi can’t help but find its way into becoming one of the most indispensable sources for education in the DeFi space.

The wide-ranging educational resources of De.Fi form the backbone for furnishing users with risk-mitigating, leading-edge knowledge. Whether you want in-depth protocol analyses, security updates, or yield maximization tutorials, be sure that at De.Fi, one’s users are equipped to go into the DeFi jungle with confidence.

Get Started Today With De.Fi

For those looking to upgrade from CoinMarketCap and find a more comprehensive solution for tracking, managing, and securing their crypto assets, De.Fi offers everything you need. With advanced tools like the Explore Yields tool, the comprehensive Portfolio Dashboard, and a strong focus on security, De.Fi is the best CoinMarketCap website alternative.

Whether you’re an experienced DeFi user or just starting your journey, De.Fi provides the tools and resources to help you succeed. Start using De.Fi today and take control of your crypto investments with confidence!